Chinese Gamblers Expected to Boost Business at New Asian Casino Destinations

Posted: March 21, 2014

Updated: October 4, 2017

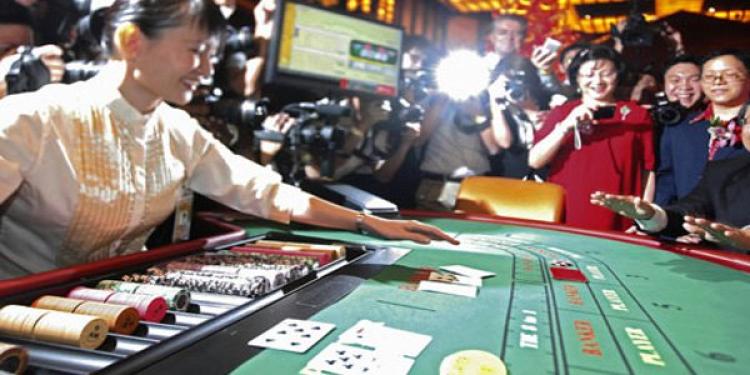

New casino projects in Asia largely depend on whether Chinese gamblers will go there to enjoy gaming.

With giant casino operators moving to the far corners of the world to build their latest casino establishments, will the players follow them? The biggest assumption for new casino resorts being built in Asia is that the Chinese players will be coming to play there, but let’s see if they actually will leave the country with restrictive Chinese gambling laws and travel far to gamble.

Investment manager at a renowned company Aberdeen, Bharat Joshi, commented: "Everybody's counting on Chinese tourists. Chinese gamblers do travel and they follow the junkets and wherever the junkets have a credit line."

According to the manager the remote Asian casinos are offering lots of opportunities, taking into consideration that gamblers generally prefer new casino, and are often forming huge lines at the opening ceremonies. Joshi said: "It's very similar to golf courses. You want to play on different greens."

Naturally, these figures are relatively small compared to gambling market in Macau. The world’s leading gambling capital is expected to reach $55 billion in GGR this year. However, Citigroup’s estimates are favoring the market players there. Nagacorp, Melco Crown Philippines, and Summit Ascent offerings enjoy close proximity to China, as well as strong arrival growth and very favorable visa regimes.

She also opined that due to heavy restrictions on Chinese capital account, gambling is now regarded as a means of moving the money out of the country. Since land-based and online casinos in China online casinos in China are outlawed, gamers have the only option to take their gambling and money abroad.

However, there is a round of financial system reforms going on in China, and experts agree the country will open its capital account faster than previous estimates. Freya Beamish went on to add: "Illicit flows out of China will be liberalized. That particular demand for going to the casino may be diminished."

Speaking about the shift towards the consumer-based growth from the investment-based industry, Beamish was very skeptical. She opined: "It won't necessarily happen in a successful way. Investment is very weak and private consumption is by default the strongest thing in the economy."

She also expects economic growth to slow to 5 percent this year and in the years to come, as compared to an official target of 7.5 percent. The expert commented: "You're going to have a similar amount, or less, of private consumption, but private consumption is leading growth."

Macquarie also regards the Philippines domestic gambling market as an attractive one. The company’s forecast for growth of gambling industry there is even more positive than that of the Citigroup. According to Macquarie, gaming market in the Philippines may increase to almost $5 billion by 2017.

The Macquarie report said: "Not only is the Philippines seeing strong economic growth, but the demographics are also supportive of higher disposable incomes and greater growth in consumption expenditure."

It remains to be seen just how keen the Chinese gamers will be traveling to the new locations when they are completed. Another interesting point is will these gambling markets pose a threat to the current region’s leader Macau.

With giant casino operators moving to the far corners of the world to build their latest casino establishments, will the players follow them? The biggest assumption for new casino resorts being built in Asia is that the Chinese players will be coming to play there, but let’s see if they actually will leave the country with restrictive Chinese gambling laws and travel far to gamble.

Investment manager at a renowned company Aberdeen, Bharat Joshi, commented: "Everybody's counting on Chinese tourists. Chinese gamblers do travel and they follow the junkets and wherever the junkets have a credit line."

According to the manager the remote Asian casinos are offering lots of opportunities, taking into consideration that gamblers generally prefer new casino, and are often forming huge lines at the opening ceremonies. Joshi said: "It's very similar to golf courses. You want to play on different greens."

How far are these new casinos?

The new horizons for the Asian casinos include the Russian city of Vladivostok, which is only two hours away from Beijing by plane. Other “far” places are Manila and Cambodia, which are about four hours away from the Chinese capital.Economic forecasts for the new casino regions

According to the latest research findings, the forecasts for the new Asian casino regions are extremely popular. Citigroup says Vladivostok Gross Gaming Revenue (GGR) will reach $1.7 billion by the year 2020, up from an estimated $410 million in 2016. Manila’s GGR is expected to increase at a nice 16 percent compound annual rate and reach almost $6 billion by 2020.Naturally, these figures are relatively small compared to gambling market in Macau. The world’s leading gambling capital is expected to reach $55 billion in GGR this year. However, Citigroup’s estimates are favoring the market players there. Nagacorp, Melco Crown Philippines, and Summit Ascent offerings enjoy close proximity to China, as well as strong arrival growth and very favorable visa regimes.

Another research and more predictions

China is currently concerned about a slowing economic growth and widespread corruption crackdowns. These are the factors behind some consumers trying to avoid gambling in order to hide their conspicuous consumption. Gambling is the ultimate discretionary spending, and will probably be the first expense to cut by worried consumers.New Asian casino regions receive positive forecastsAccording to an economist at Lombard Street Research, Freya Beamish, the positive forecasts for the new casino regions widely depend on "how much money people have to be playing around with and how much do people want to get money out of China."

• Gambling resorts in Asia largely rely on Chinese gamers to be successful • Chinese gambling laws prohibit any gaming activity in the country making gamblers travel abroad

• Optimistic forecasts say the new resorts can even sustain themselves without the Chinese

She also opined that due to heavy restrictions on Chinese capital account, gambling is now regarded as a means of moving the money out of the country. Since land-based and online casinos in China online casinos in China are outlawed, gamers have the only option to take their gambling and money abroad.

However, there is a round of financial system reforms going on in China, and experts agree the country will open its capital account faster than previous estimates. Freya Beamish went on to add: "Illicit flows out of China will be liberalized. That particular demand for going to the casino may be diminished."

Speaking about the shift towards the consumer-based growth from the investment-based industry, Beamish was very skeptical. She opined: "It won't necessarily happen in a successful way. Investment is very weak and private consumption is by default the strongest thing in the economy."

She also expects economic growth to slow to 5 percent this year and in the years to come, as compared to an official target of 7.5 percent. The expert commented: "You're going to have a similar amount, or less, of private consumption, but private consumption is leading growth."

Can new casinos survive without the Chinese gamblers?

Naturally, they can. The gambling market in Asia is underpenetrated to state the least. The December report from Macquarie, a renowned investment banking company, revealed a rapidly growing number of wealthy individuals ready to gamble in the region. The acceptance of integrated casino resorts as a form of holiday and entertainment is growing with them, suggesting positive prospects for the operators.Macquarie also regards the Philippines domestic gambling market as an attractive one. The company’s forecast for growth of gambling industry there is even more positive than that of the Citigroup. According to Macquarie, gaming market in the Philippines may increase to almost $5 billion by 2017.

The Macquarie report said: "Not only is the Philippines seeing strong economic growth, but the demographics are also supportive of higher disposable incomes and greater growth in consumption expenditure."

It remains to be seen just how keen the Chinese gamers will be traveling to the new locations when they are completed. Another interesting point is will these gambling markets pose a threat to the current region’s leader Macau.

Related content

Subscribe

0 Comments